Building awesome investor decks – a game of greed and fear

Posted by

Rhian Jarman

SETsquared Bristol ran a workshop on how to build a winning investor deck and tell a compelling story. The session was led by David Fogel, Co-founder and Investment Lead at ADV, whose focus is on finding the most ambitious founders in the UK and helping them grow using ADV’s capital and network. Here we share our top tips from the session.

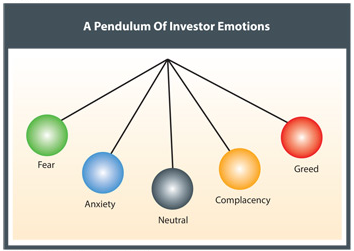

Securing investment is all about connecting with people. Believe it or not, investors are people too and are also motivated by emotions, so you need them to be able to relate to and care about the problem you’re solving. Your job is to move them from fear to greed with the right narrative by reducing the likelihood of fear. But how is this done? Well, it’s all about how you build your story – your deck.

Securing investment is all about connecting with people. Believe it or not, investors are people too and are also motivated by emotions, so you need them to be able to relate to and care about the problem you’re solving. Your job is to move them from fear to greed with the right narrative by reducing the likelihood of fear. But how is this done? Well, it’s all about how you build your story – your deck.

Understanding your investors

Make sure you understand different types of investment channels and get to know the investor in order to get the messaging right and include the relevant information for them. It’s better to raise less money from the right type of investor that is aligned with your business, than lots of money from an investor that isn’t aligned – as your business will end up becoming something different.

The investor story

Your customer story sells the product to your customers, but the investors’ product is your company. What investors want to hear is ‘the investor story’, which is completely different to your product pitch. Investors will want to hear that you’ll grow fast, will be big, and that you’re the only ones that can do it. If your business doesn’t have potential to create revenue, no investor will care. Your deck is not about text, you need to model your ambition in numbers to show your unit economics and use data as evidence. Don’t tell them you are good, show them with numbers – it’s the language that investors understand.

From fear to greed

From fear to greed

Show them the future first – a world where you’ve already won. Find that vision of what you’re going to build and articulate how your industry will develop based on megatrends. Plot the journey to map out how the commercial and product development will look in ten years. Create the expectancy and understanding of the stages the industry will go through, and what it could be impacted by, for example, climate change, the shifting energy market, an aging population, or a shift in global economic power. Describe how you’re at the cusp of these changes for your business to take best advantage of it. If you bring that ‘something extra’ to investors, you’ll stand out. Once you’ve modelled this, it’s much easier to sell your vision. The next job is to reverse engineer it and work backwards to where you are now.

Everything that you’re going to build is based on assumptions – investors know this, but it’s not a problem. Don’t hide your weaknesses. Investors are good at spotting them and will know that every startup has them, but they’ll need to know how you plan to mitigate them.

Building the Deck – why should an investor care?

Building the Deck – why should an investor care?

The first section of your deck should sell this future vision and build a narrative. The second part should start with the now – what do you actually have? Don’t open with a discussion about the past, start from today and state your purpose. Every organisation knows what they do, some organisations know how they do it, but very few know why they do what they do. It’s important to state your purpose, cause or belief – it’s the reason your organisation exists. Note that ‘the why’ isn’t about making money – this is merely the result.

Next, evidence the product. Is the problem you are solving a headache or a migraine? The bigger the pain you’re solving, the better. Quantify how big it is in your deck and describe how your product is unique, better and how it solves the migraine. Talk about your business model and unit of economics (per unit of how you sell), as well as the core USP (unique selling point) that drives adoption and value to the user.

Investors will also look at your team, so it’s important to explain why they are uniquely positioned to win in this industry. Show the specific value in your team, with insight about their experience and skillset they bring that makes them unique in their position.

The last point should express the unique opportunity. Remember, you’re not begging, you’re selling part of your company. Convince them that you’re giving them an opportunity for them to invest in a business that’s going to make loads of money.

Make sure your deck includes:

Make sure your deck includes:

- Revenue

- Unit of Value (the smallest measurable unit at which your product or service delivers value)

- Unit of Economics

- Product/Technology

- Key industry impactful events

- Any main milestones you think are important

Tips for slide creation:

- Include one message per slide

- The headline is the main message

- The body of the slide is data to evidence the message

- Too many messages will get lost

- Include 20-30 slides max, but to convey it in less is better, as long as it doesn’t dilute the message

Your deck should evolve over time, don’t expect to use the same one years later. Remember, the deck is just a marketing sales tool to sell your company, but getting it right is crucial to get you to the next stage.

Caveat Emptor: this guidance is based on personal opinion, readers should use their own judgement as to what is appropriate for their business.

Recent News, Blogs and Stories