How to look at your company like an investor

Posted by

Rhian Jarman

Not all investors are equal. They each have different expectations and require subtly different information to be able to make a decision. So how do you know what kind of investor is best for your company? Stephen Bennington, Founder and Director of Krino Partners, runs workshops for SETsquared Bristol to help you to think like an investor: what they are looking for when they evaluate a new proposition, and how they make money out of your business.

Why Equity?

Equity funding is useful for early stage companies who cannot raise debt due to lack of revenue or assets. There are many benefits, such as accelerating growth, providing validation, longevity and expertise, and you shouldn’t have to pay the money back until you sell the company. Although, unlike grant or debt funding, equity will dilute your ownership and compromise control as well as being expensive and extremely time consuming.

Return versus Risk. How do investors decide?

Return versus Risk. How do investors decide?

Investors are trying to make money in an uncertain world. Only around a fifth of their investments are likely to pay back, so they will weigh up the potential returns versus the risk of investing in your business. To address this, you’ll need to map an enterprise risk table, specifying the potential risks (technical, commercial, market etc) and how you will mitigate them, ready for investors’ inevitable questions. Fail early/fast is better for both the investor and arguably the entrepreneur as well.

Calculating the value of your business is very difficult, especially for a startup, but it’s essential to have an idea of what your company is worth before talking to investors. You can determine the value by researching comparable companies and the ratio of their market capitalisation (number of shares times the value price that previous investors paid) to their earnings and applying it to your own company. If you don’t yet have revenue you’ll need to use projections of future revenue and discount it back to the present. None of these are easy to do and ultimately the value will be whatever someone is willing to offer you.

To calculate their return on investment (ROI), investors will want to consider your exit strategy: how much you’ll get for it and when. This could be a floatation on the stock market (an Initial Public Offering IPO), but the most common exit at the moment is a sale of the company to larger company. Position yourself so that you are ready and known by the companies who might want to buy your business at the end.

Understanding the investor

Research the individual or company, as well as the size, type and age of the fund to understand what they are looking for. It is important to be sure that the type of investment is right for your business. Running a company on behalf of someone else can be very difficult, especially if you’re not ethically aligned. Understand the people who run the fund, look at their skills and experience and target your approach. Talk to other companies they have invested, and study them on Crunchbase or Dealroom to see if what they say on their website matches what they actually do. Check if there is a sector or geographical focus. Look at their investment portfolio to find out if they usually provide earlier or later stage investment, research the amounts they have invested and the exits they’ve had. And perhaps most importantly, can you see yourself working with them?

Which type of investment and when?

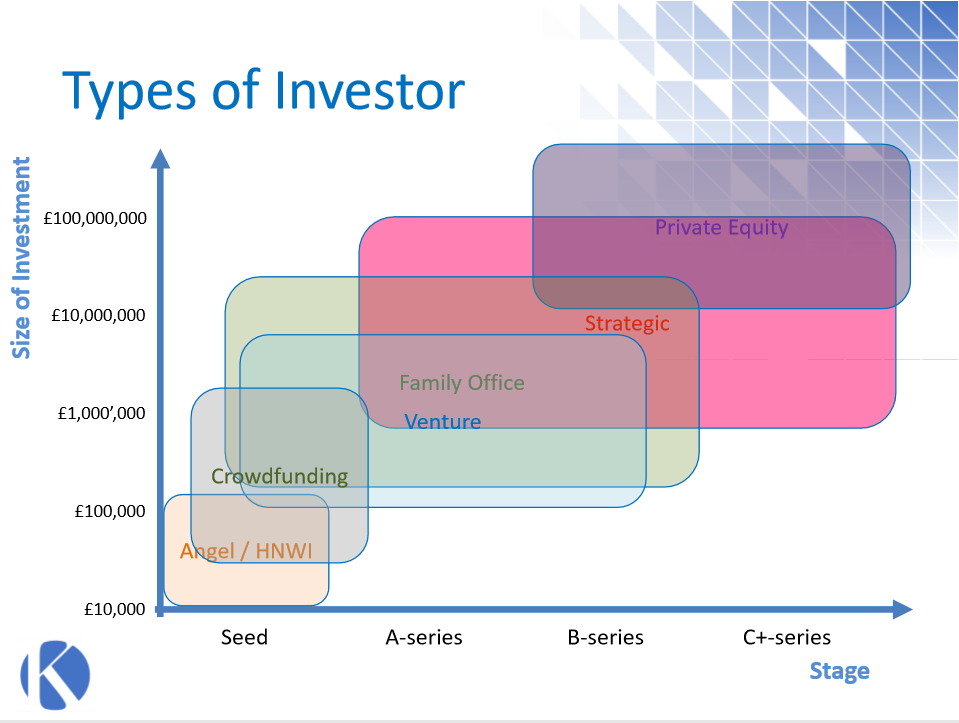

The type of investors you target will depend on the growth stage of your business. Startups typically go through rounds of funding at different growth stages in order to raise capital. Seed phase is for early stage startups, series A after some track record is established, B for well established businesses, and C plus to scale or merge. Each type of investor operates in different parts of this space.

Each type of investor comes with its pros and cons, so it’s imperative to do your research. Some investors, such as Angels, can take a more involved approach in your business – they can be excellent mentors for early stage businesses, and teach you a huge amount if you find the right ones. If you have a cool and interesting new product that you’d like to get into the hands of niche early adopters, then crowdfunding might be a good first route – you’ll need to spend time creating an engaging campaign, but beware of negative press if it goes wrong! Venture Capitalists (VCs) can help you understand and structure your business for exit and usually have excellent networks but are known to push the valuation hard. Strategic investors are larger companies with a strategic alignment with yours. Access to their technical, market and regulatory expertise should be very valuable. They may have a view to buy your product or service, understand your technology, access your team and talent or acquire your company.

Selling your business to investors

Remember, you are not selling your product, you are selling yourselves and your business. Specify the amount of investment you need, what you will use it for and your plans for exit. A well written and structured executive summary is essential, as well as your pitch (investor deck) and business plan. Be optimistic but honest in your business plan, but don’t exaggerate, it must be justifiable. Taylor your investor pack to connect with the individual investor and type of investment. For example, it’s advisable to focus on the financial, team, skills and experience for Angel investors. A business plan with good and justifiable projections is essential for VCs, and for strategic investors, you’ll need to focus more on the tech and IP, the skills of your team, and how your product aligns with their business. Read more about writing a business plan in this blog.

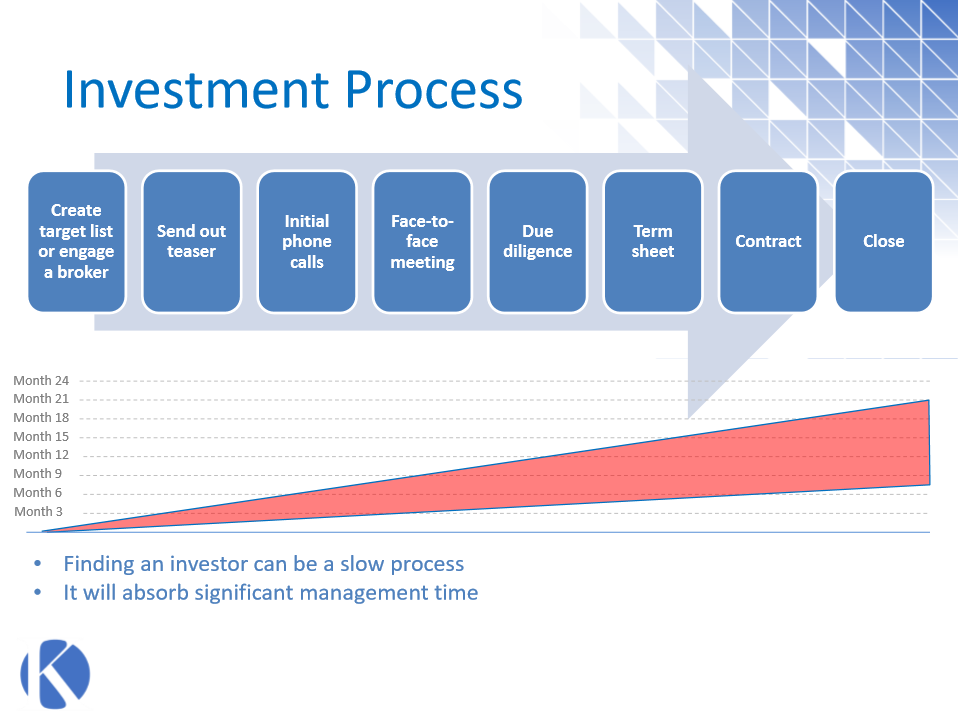

Raising funds is an expensive and time-consuming business, and can take up to two years, so forward planning is key. When you’ve secured your first investment round, understand the time horizon for the next one, the process may need to start soon after.

Caveat Emptor: this guidance is based on personal opinion; readers should use their own judgement as to what is appropriate for their business.

Recent News, Blogs and Stories